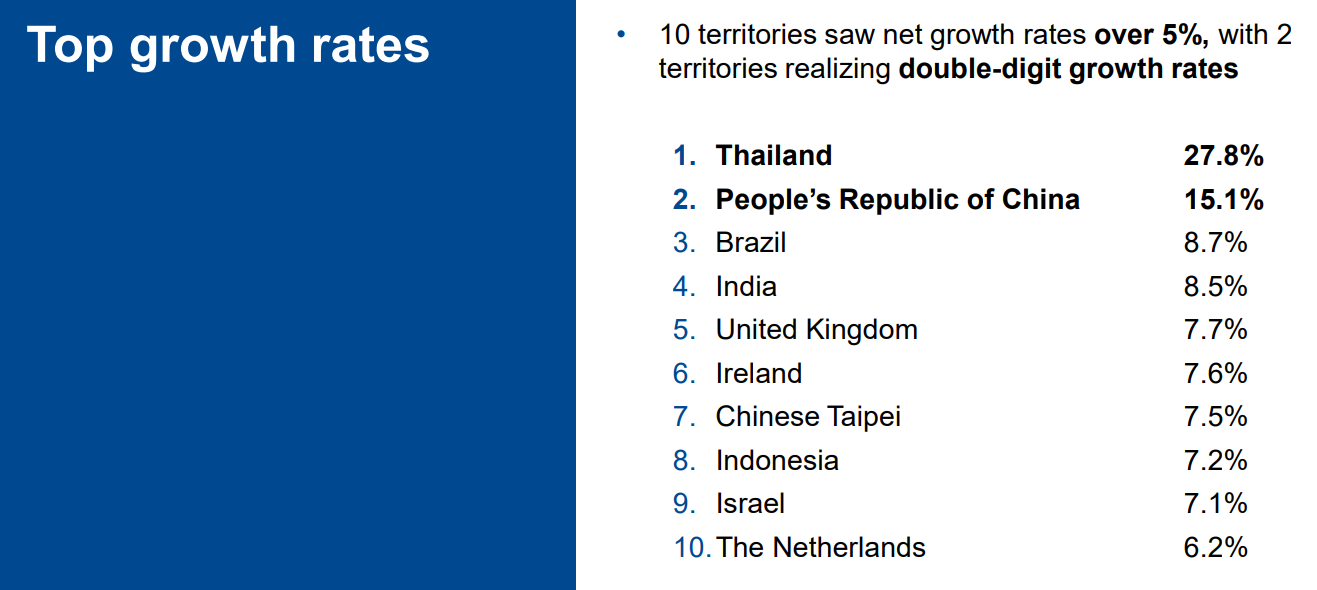

India’s CFP Professional Community Soars to Record High of 2,731, Surging 8.5% Amidst Booming Demand for Professional Financial Planning Guidance

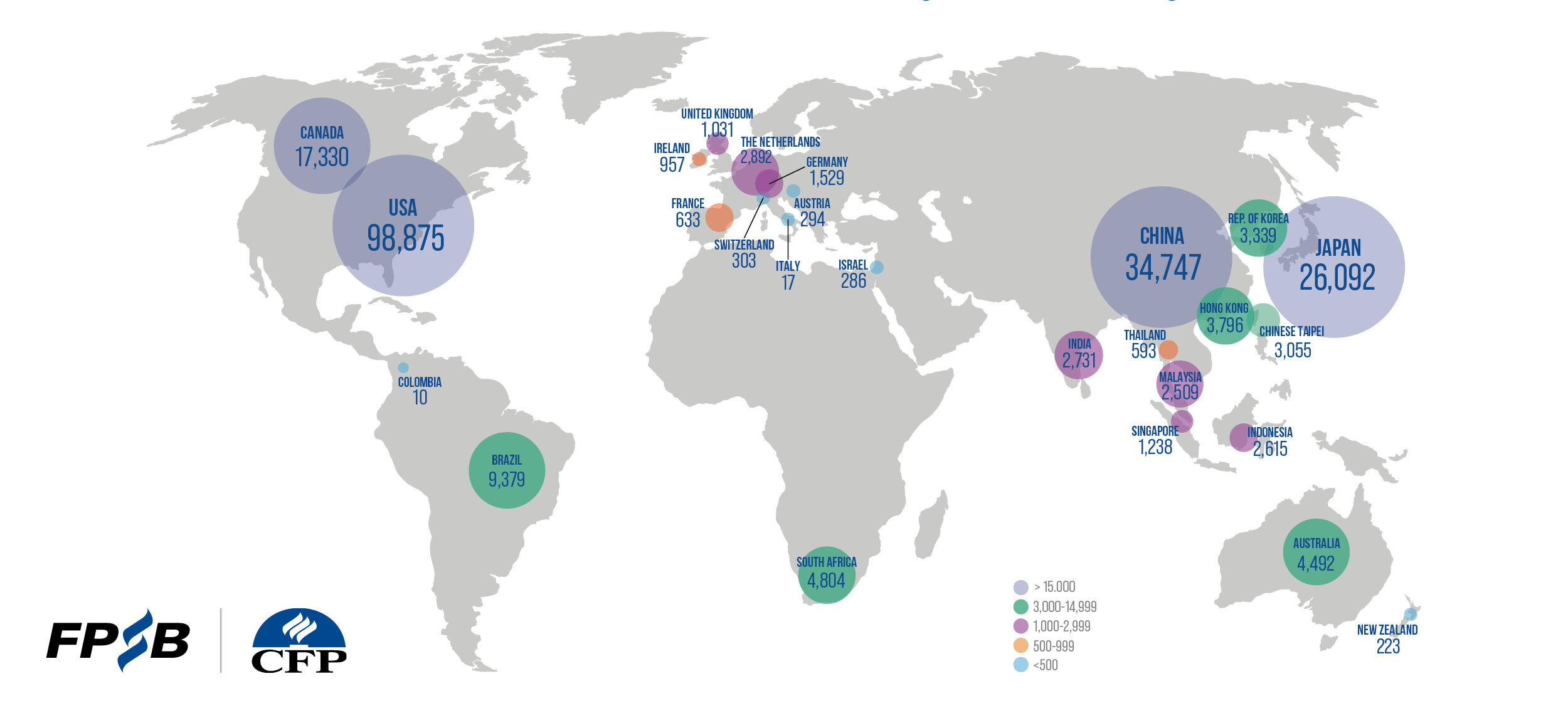

- Global CFP professional community soars 5.1%, reaching 223,770 as of December 2023

- India witnessed 4th highest net growth rate in the world

India, 15 February 2024 – With more than 50% of people who have never received financial planning advice intending to seek it within the next three years*, Financial Planning Standards Board (FPSB) is pleased to report the number of CERTIFIED FINANCIAL PLANNER professionals worldwide grew by 5.1% over the previous year. FPSB and its global network of organizations increased the number of global CFP professionals by 10,768 to a total of 223,770 as of 31 December 2023. India saw a surge in demand for professional financial advice, with the community registering a record 2731 CFP professionals over the year with a 8.5% growth.

The growth in the number of CFP professionals complements findings from the FPSB Value of Financial Planning Global Consumer Research 2023 that shows those who work with CFP practitioners report a better quality of life, enjoy more financial confidence and resilience, and are more satisfied with their financial situation, with 98% of clients reporting they trust their CFP professional to act in their best interests.

“We’re pleased to see the number of CERTIFIED FINANCIAL PLANNER professionals continues to increase year-over-year to meet the rising demand for professional financial planning advice,” said FPSB CEO Dante De Gori, CFP. “As the global community of CFP professionals grows, more people around the world can access financial planners who have committed to high standards of competency, ethics and practice to build holistic financial plans as they face increased costs of living and complex financial decisions. For nearly three decades, the global CFP professional community has steadily grown, reaching its highest ever at over 223,700. This growth is a true testament to the value CFP certification holds in the global financial planning profession and the clients Certified Financial Planners serve”.

Sharing the numbers, Krishan Mishra, CEO, FPSB India said, “We are thrilled to announce that India’s CFP professional community has reached an unprecedented milestone, boasting 2,731 dedicated professionals committed to delivering high-quality financial guidance. This remarkable 8.5% surge reflects not only the growing demand for financial planning advice in our country but also underscores the increasing importance individuals place on securing their financial future. As India proudly ranks among the top 5 in global net growth rates, this achievement speaks volumes about our nation’s dedication to fostering financial literacy and stability. Together, we continue to empower individuals to make informed financial decisions and navigate their journey towards prosperity.”

|

|

|

CFP professionals around the world are helping clients build holistic financial plans to achieve their goals, as they continue to deal with global economic uncertainty and inflation. The global community of 223,700+ CFP professionals commit to rigorous standards of competency, ethics and practice and to putting clients’ interests first.

For further details on worldwide CFP professional growth in 2023, view FPSB’s infographic

About FPSB

About FPSB

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and FPSB and the FPSB global network administer CFP certification and other programs in the following territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2023, there were 223,770 CFP professionals worldwide. For more, visit fpsb.org

FPSB owns the CFP, CERTIFIED FINANCIAL PLANNER and trademarks (the CFP Marks) outside the United States, and permits qualified individuals to use the marks to indicate that they meet FPSB’s initial and ongoing certification standards and requirements. CFP professionals may use the CFP marks in the territory in which they are certified.

About FPSB India:

FPSB India is the leading financial planning body in India and is dedicated to establishing, upholding, and promoting professional standards in financial planning throughout India.

FPSB India offers the globally recognized CFP certification, which represents excellence in financial planning through rigorous competency and ethical standards. It is home to over 2,700 CFP professionals in India and part of a global network of organizations representing more than 223,700 CFP professionals worldwide.

FPSB India is the Indian subsidiary of Financial Planning Standards Board Ltd. (FPSB Ltd.), the global standards-setting body for the financial planning profession and owner of the international CERTIFIED FINANCIAL PLANNER certification program.

FPSB Ltd. owns the CFP, CERTIFIED FINANCIAL PLANNER and the outside the United States. FPSB Ltd. licenses these marks to FPSB Institute India Pvt. Ltd to administer CFP certification in India. For more information, visit india.fpsb.org

About CFP Certification:

CFP certification is the global symbol of excellence in financial planning and represents financial planners who commit to standards of competency and ethics, and to putting clients’ interests first. The CERTIFIED FINANCIAL PLANNER credential represents financial planning professionals who commit to better serving their clients through rigorous international standards, ethical practices and lifelong learning.

CFP Certification Global excellence in financial planning™

* FPSB Value of Financial Planning Global Consumer Research 2023

FPSB India Names Krishan Mishra As New CEO

Mishra to assume role 1 August 2023

Mumbai, India – 04 July 2023 ─ FPSB India today announced that Krishan Mishra has been appointed as its chief executive officer, effective 1 August 2023.

In his new role, Mishra will lead the strategy and operations of FPSB India and champion the advancement of the financial planning profession in India with CFP marks its symbol of excellence in financial planning.

In his new role, Mishra will lead the strategy and operations of FPSB India and champion the advancement of the financial planning profession in India with CFP marks its symbol of excellence in financial planning.

FPSB India is the Indian subsidiary of FPSB Ltd., the global standards-setting body for the financial planning profession and owner of the international CERTIFIED FINANCIAL PLANNER certification program.

Mishra brings more than 20 years of experience in the financial services, education and technology sectors, across operations, business and strategy development, marketing and corporate sales.

He has held a variety of leadership positions including Country Head-International Business (India and South Asia) of Becker Professional Education, Head of North and East India of Association of Chartered Certified Accountants, and Regional Head (East) and Business Head-Channel Business at HCL Infosystems Ltd. Prior to these roles, he spent over a decade in the financial services industry.

“I am very pleased Krishan Mishra will step into the role as CEO of FPSB India,” said FPSB CEO Dante De Gori, CFP®. “Krishan’s experience in the financial services and education sectors, combined with his strategic expertise, will support the growth of the Indian CFP professional community and propel the financial planning profession in India forward.”

“I’m honored to take the helm of FPSB India as its CEO to continue to strengthen the CFP professional community in India. With five years of consecutive growth in the number of CFP professionals, the value of CFP certification remains strong in our country, and I’m committed to supporting practitioners who commit to rigorous standards of competency, ethics and practice to benefit the financial planning profession and members of the public,” said Mishra. “CFP certification is the global symbol of excellence in financial planning, and I look forward to harnessing opportunities with key stakeholders to advance the financial planning profession with these marks of professionalism.”

Mishra is an alumnus of the Indian Institute of Foreign Trade (IIFT), Delhi and the Entrepreneurship Development Institute of India, Ahmedabad. He is also a Chartered Manager Fellow from the Chartered Management Institute, UK.

He was recognized in 2019 as one of the Top 100 Leaders in Education for his significant contributions to the field of education at the Global Forum for Education and Learning.

About FPSB India

FPSB Institute India Pvt. Ltd. is the Indian subsidiary of FPSB Ltd., the global standards-setting body for the financial planning profession and owner of the international CERTIFIED FINANCIAL PLANNER certification program. For more information, visit india.fpsb.org.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and – which it owns internationally. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2022, there were 213,002 CFP professionals worldwide. For more, visit fpsb.org

Number of CERTIFIED FINANCIAL PLANNER® Professionals in India Increased By 7% Over the Previous Year

CFP® professionals worldwide now surpass 213,000

DENVER, COLO – 23 FEBRUARY 2023 – Financial Planning Standards Board Ltd. (FPSB), owner of the international CERTIFIED FINANCIAL PLANNER® certification program in India, announced today that the number of CFP® professionals in India grew by 7.7% last year, reaching a total of 2,517 CFP professionals at 31 December 2022. The CFP professional growth story in India is part of a growing global trend, where last year the number of CFP professionals around the world reached an all-time high of 213,002.

“As we celebrate 20 years of the first class of candidates who earned their CFP certification in India this year, I’m pleased to report the growth of CERTIFIED FINANCIAL PLANNER professionals in India is increasing, in concert with the global CFP professional community,” said FPSB CEO Dante De Gori, CFP. “India’s actual growth in the number of CFP professionals placed it in the top seven globally, with a net increase of 179 CFP professionals. This continuous growth is a true testament to the value CFP certification holds in India’s financial planning community and the global financial planning profession. We applaud all CFP professionals in India who commit to rigorous standards and to putting their clients’ interests first.”

FPSB has seen strong growth in the Indian CFP professional community over the past several years. Recent efforts including the National Institute of Securities Markets (NISM) accreditation of FPSB’s CFP certification program, the launch of a new education and credentialing pathway to CFP certification, re-introduction of the Challenge Pathway to help eligible financial planning professionals accelerate their path to CFP certification, along with other efforts, can be attributed to last year’s growth that resulted in 1,179 candidates enrolling in our education and certification programs and 325 newly-minted CFP professionals last year.

“With more than 2,500 CFP professionals in India and increasing the number of CFP professionals globally nearly two and a half times since FPSB’s creation in 2004, continuous growth of the India CFP professional community is promising,” added De Gori. “As more aspiring professionals seek rewarding careers in financial planning, we will continue to deepen relationships with key stakeholders in India to foster new entrants into the profession and advance financial planning in India as a respected profession, with CFP certification as its symbol of excellence.”

To learn more about worldwide CFP professional growth in 2022, view the infographic on FPSB’s website.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and – which it owns internationally. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2022, there were 213,002 CFP professionals worldwide. For more, visit fpsb.org.

###

CFP Certification Global Excellence in Financial Planning™

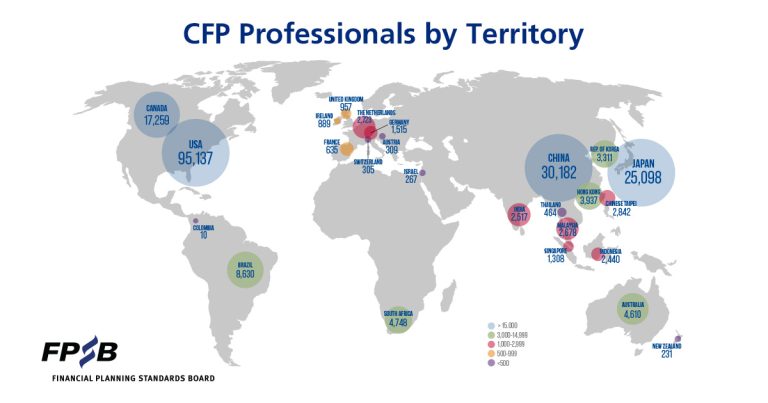

CERTIFIED FINANCIAL PLANNER Professionals Worldwide Surpasses 213,000

Number of CFP professionals has increased ten-fold since 1990, when CFP certification first went international

DENVER, COLO – 7 February 2023 – Financial Planning Standards Board Ltd. (FPSB)→, the standards-setting body for the global financial planning profession and owner of the international CERTIFIED FINANCIAL PLANNER certification program outside the United States, reports the number of CFP professionals worldwide has surpassed 213,000. With a gain of 9,690 CFP professionals last year, FPSB and its global network of organizations grew the number of CFP professionals worldwide by nearly 5% to a total of 213,002, as of 31 December 2022.

“We’re pleased to report the number of CERTIFIED FINANCIAL PLANNER professionals worldwide continues to grow, reaching its highest ever at over 213,000. Our robust global community of CFP professionals means people around the world have access to financial planning from those who have committed to rigorous standards of competency, ethics and practice,” said FPSB CEO Dante De Gori, CFP. “With global economic uncertainty and the rising costs of living impacting so many, increased access to financial planning advice is of utmost importance to help individuals and families stay on track to reach their goals and achieve financial well-being.”

Americas and Asia-Pacific regions realized the highest increase of CFP professionals in 2022. The top six growth markets for CFP professionals were:

- People’s Republic of China, with an increase by FPSB China→ of 3,382 CFP professionals for a year-end count of 30,182, representing the second-largest CFP professional community in the world

- United States, with an increase by CFP Board→ of 3,082 CFP professionals for a year-end count of 95,137, representing the largest CFP professional community in the world

- Brazil, with an increase by Planejar – Associação Brasileira de Planejamento Financeiro→ of 1,245 CFP professionals for a year-end count of 8,630

- Japan, with an increase by Japan Association for Financial Planners→ of 1,034 CFP professionals for a year-end count of 25,098

- Canada, with an increase by FP Canada→ of 462 CFP professionals for a year-end count of 17,259

- Chinese Taipei, with an increase by Financial Planning Association of Taiwan→ of 410 CFP professionals for a year-end count of 2,842

The six territories with double-digit growth rates in the number of CFP professionals last year were Thailand (21.1%), Brazil (16.9%), Chinese Taipei (16.9%), Israel (16.6%), People’s Republic of China (12.6%) and Singapore (10.8%).

“Increasing the number of CFP professionals nearly two and a half times globally since FPSB’s creation in 2004 reinforces the value CFP certification holds in the global financial planning profession,” added De Gori. “With 26 years of continuous growth of CFP professionals, we are grateful for FPSB’s network of organizations and the hundreds of thousands of CFP professionals who support the advancement of the financial planning profession, with CFP certification its symbol of excellence.”

For further details on worldwide CFP professional growth in 2022, view FPSB’s infographic→.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and ![]() – which it owns internationally. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2022, there were 213,002 CFP professionals worldwide. For more, visit fpsb.org→.

– which it owns internationally. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2022, there were 213,002 CFP professionals worldwide. For more, visit fpsb.org→.

# # #

CFP Certification Global excellence in financial planning™

Financial Planning Standards Board Names 2023 Leadership from Australia, Brazil, Canada, Ireland, Japan, the Netherlands and Singapore

DENVER, COLO – 27 October 2022 – Financial Planning Standards Board Ltd. (FPSB)→, the standards-setting body for the global financial planning profession and owner of the CERTIFIED FINANCIAL PLANNER certification program outside the United States, is pleased to announce newly-elected leaders from around the globe to serve on the FPSB Board of Directors, Professional Standards Committee and Network Forums in 2023.

Andrea Middel, CFP, has been elected as FPSB Board Chairperson-elect, to serve a two-year term starting 1 April 2023. Middel is partner at DURF Financial Planners in the Netherlands and joined the FPSB Board in 2019. She currently serves as chairperson of the FPSB Professional Standards Committee, is a member of the FPSB Compensation and Succession Planning Committee and was a member of the Board of Directors of FPSB’s Dutch Affiliate, Federatie Financieel Planners, from 2012 to 2018. Middel holds a Master’s in Financial Planning from Erasmus University.

Andrea Middel, CFP, has been elected as FPSB Board Chairperson-elect, to serve a two-year term starting 1 April 2023. Middel is partner at DURF Financial Planners in the Netherlands and joined the FPSB Board in 2019. She currently serves as chairperson of the FPSB Professional Standards Committee, is a member of the FPSB Compensation and Succession Planning Committee and was a member of the Board of Directors of FPSB’s Dutch Affiliate, Federatie Financieel Planners, from 2012 to 2018. Middel holds a Master’s in Financial Planning from Erasmus University.

“It’s been a privilege to serve on the FPSB Board of Directors over the past three years and I look forward to continuing to support the long-term success of FPSB and the global financial planning profession as chairperson-elect with my peers on the Board,” said Middel. “As the value of, and demand for, financial planning increases, it’s an exciting time to be at the helm of an organization that is committed to establishing worldwide professional standards in financial planning and future-proofing the profession to benefit the public and the global community in the years to come.”

Beginning 1 April 2023, current Board chairperson-elect Ana Cláudia Akie Utumi will serve a two-year term as FPSB Board Chairperson succeeding Garry Muriwai, and Middel will step up as 2023 Board chairperson-elect for a two-year term.

FPSB also announced two new board members each to serve a three-year term beginning 1 April 2023:

Caroline Dabu, Head of Wealth Distribution and Advisory Services at BMO Private Wealth in Canada, currently serves as chair of the FP Canada Foundation and was a former board member of the Financial Planning Standards Council from 2015-2018, now known as FP Canada. She holds a Bachelor of Journalism degree from Carleton University.</p align=”justify”>

Caroline Dabu, Head of Wealth Distribution and Advisory Services at BMO Private Wealth in Canada, currently serves as chair of the FP Canada Foundation and was a former board member of the Financial Planning Standards Council from 2015-2018, now known as FP Canada. She holds a Bachelor of Journalism degree from Carleton University.</p align=”justify”>

Brett Millard, CFP, CIM, Regional Director of IG Wealth Management in Canada, is former director and chairperson of FP Canada’s Board from 2014 – 2021 and was a member of the FPSB Council from 2018-2020. He holds a business degree from Thompson Rivers University.</p align=”justify”>

“I’m pleased to welcome Andrea, Caroline and Brett to their respective roles on the board of directors of Financial Planning Standards Board Ltd.,” said FPSB Board chairperson Garry Muriwai. “As staunch advocates for the financial planning profession, the Board looks forward to tapping into their leadership and expertise to drive our global strategy to establish financial planning as a global profession with CFP marks its symbol of excellence and support the FPSB Network and growing global community of more than 203,000 CFP professionals.”

Dabu and Millard will join six other volunteers on the FPSB Board of Directors from Australia, Brazil, Mexico, South Africa, the Netherlands and the United States. More information about the FPSB Board of Directors can be found here →.

Additional elected FPSB leadership positions include:

- Ulf Mannhardt, CFP, FPSB’s Brazil Affiliate Planejar’s liaison to FPSB, and member of the FPSB Council and FPSB Nominating Committee, will chair the FPSB Council→ in 2023.

- Marisa Broome, CFP, Principal at wealthadvice.com.au Pty. Ltd. and former chairperson of the Financial Planning Association of Australia and FPSB’s Regulations Advisory Panel, will join the FPSB Professional Standards Committee (PSC) in 2023. The PSC oversees the development and maintenance of global standards for the financial planning profession and FPSB’s certification requirements.

- Mark Dukers, Directeur of Federatie Financieel Planners (the Netherlands), will join the FPSB Chief Executives Committee (CEC) in 2023. The CEC works with the FPSB Board to drive execution of the FPSB Network’s annual priorities.

- Samantha Wong, CEO of Financial Planning Association of Singapore (FPAS), was re-elected to serve a three-year term on the FPSB Chief Executives Committee.

- Emer Kirk, CFP, CEO of FPSB Ireland, will chair the 2023 FPSB Europe Forum, a forum through which FPSB’s European Affiliates can explore and address issues of mutual importance.

- Hiroaki Kuroiwa, CFP, Manager of the International Operations Section and Professional Education Section of Japan Association for Financial Planners, will chair the 2023 FPSB Asia-Pacific Forum, a forum through which FPSB’s Asian Affiliates can explore and address issues of mutual importance.

###

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2021, there were 203,312 CFP professionals worldwide. For more, visit fpsb.org.

CFP Certification Global excellence in financial planning™

Financial Planning Standards Board Ltd. Names Dante De Gori, CFP®, As New CEO

De Gori to Assume Role 1 January 2023

DENVER, COLO – 27 October 2022 – Financial Planning Standards Board Ltd. (FPSB), the standards-setting body for the global financial planning profession and owner of the CERTIFIED FINANCIAL PLANNER certification program outside the United States, today announced that Dante De Gori, CFP®, has been appointed as its chief executive officer, effective 1 January 2023.

The appointment follows the announcement in May 2022 that Noel Maye would step down as FPSB CEO at the end of December 2022.

“The Board of Directors is pleased Dante De Gori, CFP®, will step into the role as CEO of Financial Planning Standards Board Ltd. next year,” said FPSB Board chairperson Garry Muriwai. “Dante’s deep experience in, and passion for, the financial planning profession combined with his exemplary leadership skills were sought-after assets to drive FPSB’s vision and mission forward. We look forward to working with him to advance the global financial planning profession.”

“The value of financial planning and of working with a financial planner who has committed to competency and ethical standards, like a CFP professional, is becoming increasingly important with the rise of technology, fin-fluencers, geopolitical conflicts and inflation,” said De Gori. “FPSB and the global financial planning community of more than 203,000 CFP professionals play an important role in helping people realize the benefits of financial planning. I look forward to continuing my work with the FPSB team and Network to uphold and promote worldwide professional financial planning standards and raise awareness of the value of financial planning.”

With more than 20 years of leadership experience in the financial services industry, De Gori is an experienced senior executive, financial services professional, global financial planning advocate, and government relations and policy expert.

With more than 20 years of leadership experience in the financial services industry, De Gori is an experienced senior executive, financial services professional, global financial planning advocate, and government relations and policy expert.

De Gori previously served as the chief executive officer of the Financial Planning Association of Australia (FPA) – the financial planning professional body in Australia and sixth largest Affiliate within the FPSB Network. For six years, he led teams focused on standards, certification, education, events, advocacy and consumer awareness, and made exceptional contributions to the Australian financial planning profession through a period of tremendous reform to help raise education and professional standards.

De Gori served as chairperson of the FPSB Council and Chief Executives Committee (CEC) from 2018 to 2021. Earlier this year, he joined FPSB as Head of Stakeholder Engagement.

In his new role, De Gori will lead FPSB as it continues to establish financial planning as a global profession with CFP marks the symbol of excellence in financial planning.

De Gori was awarded the Association Influencer of the year 2022 by the Australasian Society of Association Executives (AuSAE) and received a Distinguished Service Award from the Future2Foundation in 2021. He is a CFP professional and holds a Bachelor of Commerce (Finance & Marketing), a graduate certificate in Politics and Policy and a diploma in Financial Planning. He has undertaken the Australian Institute of Company Directors (AICD) course and is completing a Master of Laws at Australian National University.</p align=”justify”>

“As incoming CEO, I’m honored to follow Noel Maye and continue efforts of building and future-proofing the global financial planning profession. A true advocate and pioneer, Noel has been instrumental in paving the way to establish financial planning as a distinct profession with CFP certification its global symbol of excellence,” said De Gori.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2021, there were 203,312 CFP professionals worldwide. For more, visit fpsb.org.

###

CFP Certification Global excellence in financial planning™

IOSCO Secretary General, FPSB CEO Discuss the Impact of Financial Planning on Investor Resilience This World Financial Planning Day

For information on India territory events hosted by FPSB India, visit www.WorldFPday.org

Access to the FPSB-IOSCO Virtual Fireside Chat will be available from 5th October, Wednesday morning onwards at www.WorldFPday.org

Mumbai – 2nd October 2022 – The Financial Planning Standards Board Ltd. (FPSB), India Liaison Office along with its global network of financial planning professional bodies will host the sixth annual World Financial Planning Day (WFPD) on Wednesday, 5 October, in partnership with the International Organization of Securities Commissions (IOSCO) World Investor Week (WIW) from 3-9 October, to promote global consumer financial literacy and resilience.

In a Fireside Chat to be broadcasted on FPSB social media channels on World Financial Planning Day, FPSB CEO Noel Maye and IOSCO Secretary General Martin Moloney discuss IOSCO’s goals for World Investor Week, the challenges facing members of the public as they seek to manage finances and plan for the future, and the impact that financial planning and a global community of CFP professionals can have on consumer wellbeing and resilience. “Financial planning plays a critical role in helping a client build financial resilience and be able to deal with the problems that come around the corner for all of us,” said IOSCO Secretary General Martin Moloney.

FPSB’s World Financial Planning Day raises awareness among the public about the value of financial planning, of having a financial plan, and of working with a financial planner who has committed to competency and ethical standards, like a CERTIFIED FINANCIAL PLANNER professional.

“Given the impacts of an increasingly digitalized world, cryptocurrencies, finfluencers, geopolitical conflicts, inflationary trends and lingering uncertainty around COVID, it’s more important than ever that FPSB and the global CFP professional community promote the value of financial planning and having a plan,” said FPSB CEO Noel Maye. “This World Financial Planning Day, we want the public to know how financial planning can help them feel more confident and in control of their finances, keep them on track with goals, and live their today while planning their tomorrow.”

FPSB India is part of the FPSB Network, representing more than 203,000 CFP professionals worldwide. FPSB’s global network of financial planning professional bodies will host a series of programs and events to raise awareness of the value of financial planning in celebration of World Financial Planning Day.

FPSB India has joined hands with the National Stock Exchange of India to organize a bell-ringing ceremony on 4 October to kick off World Financial Planning Day. It is also planning to host a series of media activities and virtual discussions with CFP professionals on the evolution and value of financial planning, a live YouTube session with a CFP practitioner on personal finance, and in-person sessions with students and employees on the importance of financial planning in the first week of October.

For more information about World Financial Planning Day visit WorldFPday.org and follow the #WFPD2022 conversations on FPSB social media channels. To view the on-demand FPSB and IOSCO Fireside Chat, please tune into FPSB social media channels LinkedIn, Facebook and Twitter during World Financial Planning Day on 5 October.

FPSB, Global CFP Professional Community Promote Value of Financial Planning During 6th World Financial Planning Day

Financial Planning Standards Board Joins International Organization of Securities Commissions to Raise Awareness of, Promote Financial Literacy During IOSCO’s World Investor Week

DENVER, COLO – 23 August 2022 – Financial Planning Standards Board Ltd. (FPSB), the standards-setting body for the global financial planning profession and owner of the CERTIFIED FINANCIAL PLANNER certification program outside the United States, and its global network of organizations will host the sixth annual World Financial Planning Day on 5 October, in partnership with IOSCO’s World Investor Week, which runs from 3-9 October.

World Financial Planning Day raises awareness of the value of financial planning, of having a financial plan, and of working with a financial planner who has committed to competency and ethical standards, like a CERTIFIED FINANCIAL PLANNER professional.

FPSB’s network of organizations representing more than 203,000 CFP professionals worldwide, will host a series of programs and events that demonstrate how financial planning can help individuals make financial decisions to achieve their life goals, now and into the future.

“During a time of global economic uncertainty, people may feel vulnerable and concerned about their finances and their futures,” said FPSB CEO Noel Maye. “World Financial Planning Day provides the global financial planning profession with the opportunity to educate the public about financial matters, and demonstrate how financial planners who have committed to putting clients’ interests first, like CFP professionals, can help people navigate complex financial decisions to live their today and plan their tomorrow.”

For the sixth year, FPSB has partnered with the International Organization of Securities Commissions (IOSCO) to host World Financial Planning Day during World Investor Week, a global campaign designed to raise awareness of financial literacy and investor protection. This collaboration highlights the role the global financial planning profession plays in supporting regulators to ensure better financial outcomes for people all over the world.

“World Financial Planning Day is a not-to-be-missed appointment within the IOSCO World Investor Week calendar. Investor resilience, which is one of the key themes of the WIW 2022, is very much grounded in financial planning,” said chair of IOSCO’s Committee on Retail Investors, Pasquale Munafò. “IOSCO is working together with FPSB to strengthen this link and, through our financial wellbeing and financial literacy activities, strengthen the ability of retail investors and financial consumers around the world to set goals, to stay focused on what matters most, and to be better prepared to deal with uncertain times.”

“FPSB is pleased to collaborate with IOSCO for our sixth year of dual World Financial Planning Day and World Investor Week campaigns,” added Maye. “Our CFP professional community is proud to play its part in helping the global public become more knowledgeable about finances, to feel more confident and in control during financial decision-making, and to feel empowered that their money choices will allow them to live well, both today and in the future.”

FPSB’s network of organizations will host a variety of activities leading up to and on World Financial Planning Day, including:

Events Around the World

A variety of national and local events to raise awareness about the value of financial planning, of having a financial plan and of working with a financial planner. Visit worldfpday.org and join the #WFPD2022 conversation on Facebook, Twitter, LinkedIn and Instagram to learn more.

Educational Materials for the Public

A variety of articles and resources to educate individuals on financial planning topics including steps to improve your financial wellbeing, financial guides for business owners, and how to prepare for the first meeting with a CFP professional.

Finding a CFP Professional

People around the world have access to more than 203,000 CERTIFIED FINANCIAL PLANNER professionals who have committed to working in their clients’ interests. Individuals seeking a financial planner to help them plan their future can connect with an FPSB network organization to find a CFP professional in their area.

More information about World Financial Planning Day and World Investor Week is available on worldfpday.org and worldinvestorweek.org and by joining the #WFPD2022 and #IOSCOWIW2022 conversations on Facebook, Twitter, LinkedIn and Instagram.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2021, there were 203,312 CFP professionals worldwide. For more, visit fpsb.org.

###

CFP Certification Global excellence in financial planning™

Glimpses of 2022 CFP Professional Meet

Mumbai | Kolkata | Bengaluru | Hyderabad | Delhi

Financial Planning Standards Board Recommends Enhanced Oversight of Crypto Assets and Fin-fluencers To Protect Investors

DENVER, COLO – 1 June 2022 – Financial Planning Standards Board Ltd. (FPSB), the standards-setting body for the global financial planning profession and owner of the international CERTIFIED FINANCIAL PLANNER certification program, submitted recommendations to the IOSCO Retail Market Conduct Task Force on how regulators around the world could address the potential adverse impacts of the rise of complex financial products, technology innovation and social media / fin-fluencers.

FPSB’s submission responds to the consultation led by IOSCO to inform the development of a regulatory toolkit for jurisdictions around the world to increase efforts to prevent retail investor harm.

FPSB and its global network of non-profit certification and professional bodies certify more than 203,000 CERTIFIED FINANCIAL PLANNER professionals around the world. FPSB’s submission, which draws on feedback from 886 CERTIFIED FINANCIAL PLANNER professionals across 13 different countries and territories and 16 FPSB affiliate organizations with decades of experience developing professional competency, ethics, and practice standards for the financial planning profession, highlighted the important role the global financial planning profession plays in supporting IOSCO members seeking to better protect investors.

IOSCO’s consultation comes as retail market conduct issues are escalating on a global scale in the context of the COVID-19 pandemic, rapid technological developments, and an increasingly complex and changing retail trading landscape. FPSB’s submission to IOSCO provides recommendations on issues including the impact of social media and ‘fin-fluencers’, and the need to regulate crypto assets and ensure that all who provide (or who are deemed to provide) financial advice are appropriately qualified to do so and held accountable for that advice, including fin-fluencers.

“Financial fraud and scams are certainly not new, but the rapid emergence and evolution of crypto assets and other complex digital assets means the level of risk and exposure for retail investors is becoming heightened,” said FPSB Head of Stakeholder Engagement Dante De Gori, CFP. “Licensing and product regulation are struggling to keep up with this fast-changing landscape, leaving financial planners unsure of their regulatory obligations and leaving retail investors to go it alone, guided by marketing campaigns, often with harmful consequences.”

“FPSB, the FPSB Network and the global CFP professional community have a role to play in supporting IOSCO members seeking to better protect investors in their territories. FPSB has provided IOSCO with a series of recommendations that we believe will serve retail investors and support IOSCO members efforts to develop regulatory toolkits and other measures to protect retail investors,” De Gori added.

FPSB’s recommendations to the IOSCO Retail Market Conduct Task Force include the following:

- IOSCO should conduct research to better understand the correlation between the investor’s status – either ‘self-directed’ or ‘advised’ (i.e., acting on the recommendations of a financial planning professional) – and the investor’s likelihood to experience unmanageable / catastrophic financial loss when investing in complex products (due to investment underperformance (measured against appropriate benchmark(s) or through being the victim of a scam / fraud).

- If IOSCO members continue to allow self-directed investing in complex products, self-directed retail investors’ ability to access digital trading platforms should require successful completion of a ‘financial knowledge test’ to demonstrate a minimum level of financial literacy and capability.

- IOSCO members should develop appropriate safeguards, such as the investor’s need to obtain financial advice, before permitting use of ‘leverage’ on complex products.

- IOSCO members should prohibit the use of credit cards to purchase complex financial products.

- IOSCO members should establish a regulatory ‘sandbox’ for social media influencers (fin-fluencers) and publish those operating in the sandbox on a public register, i.e., a ‘Register of Qualified Fin-Fluencers’.

- IOSCO members should proactively engage with social media influencers (aka fin-fluencers) and reinforce the boundaries in which fin-fluencers can operate, i.e., information only if not qualified to provide financial advice.

- IOSCO / IOSCO members should engage technology platforms to develop cooperation agreements to suspend or ban individuals, product providers and other organizations using the platforms to defraud or scam investors, or otherwise breach securities laws.

- IOSCO should define ‘complex products’ in a manner that can be consistently adopted across IOSCO member territories to protect retail investors (particularly, self-directed).

- As defined by IOSCO, all ‘complex products’ should be regulated.

- IOSCO should conduct research into changing guidance for ‘complex product’ providers to disclose (at the point of purchase) the percentage of retail investors who made a financial loss on the investment. Research should consider an appropriate timeframe for the disclosure, e.g., last 12 months, three years, five years or since inception.

- IOSCO members should introduce a cooling off / breaker period for ‘self-directed’ retail investors who purchase a ‘complex product,’ if such an investor protection mechanism does not already exist in the territory.

FPSB’s public comment on IOSCO Retail Market Conduct Task Force Report is available on their website.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2021, there were 203,312 CFP professionals worldwide. For more visit fpsb.org.

Noel Maye To Step Down as Financial Planning Standards Board Ltd. CEO

Maye has led the organization since it was founded in 2004

DENVER, COLO – 19 May 2022 – Financial Planning Standards Board Ltd. (FPSB), the standards-setting body for the global financial planning profession and owner of the international CERTIFIED FINANCIAL PLANNER certification program, today announced that founder CEO Noel Maye will step down from his leadership role of the organization, effective 31 December 2022.

Maye has led the organization since it was established in December 2004. Under his leadership, FPSB and the FPSB Network has:

Grown the organization’s geographical reach from 17 territories to programs in 27 territories, with discussions ongoing in several other territories;

Doubled the number of CFP professionals worldwide from 89,690 (YE’04) to 203,312 (YE’21)

Increased the number of CFP professionals worldwide ten-fold since 1990, when CFP certification first went international, from 20,353 to 203,312;

Taken over direct administration of the CFP certification program in India (2019) and grown the number of CFP professionals to 2,338 (YE’21);

Updated the content and delivery of CFP certification education and exams in India with the creation of specialist certification programs – FPSB® Investment Planning Specialist, FPSB® Retirement and Tax Planning Specialist and FPSB® Risk and Estate Planning Specialist – and online education and exam platforms now catering to 2,000+ candidates;

Secured accreditation (2021) and re-accreditation (2022) of CFP certification by the National Institute of Securities Markets (NISM) to meet Securities and Exchange Board of India’s registration requirements for investment advisors;

Developed global competency, ethics and practice standards for financial planning and global certification requirements for CFP professionals, including creating the first Global Financial Planner Competency Profile;

Published global position papers and practice guidance notes including: Regulation and Oversight of the Financial Planning Profession (2010); Fintech and the Future of Financial Planning (2016); Consumer Protection and Investment Advisor, Financial Advisor and Financial Planner Competency and Oversight in Europe (2018); and Advising Vulnerable Clients (2019);

Joined, in 2012, the International Organization of Securities Commissions (IOSCO) to represent the voice of the financial planning community during global regulatory policy discussions;

Joined, in 2015, the Organisation for Economic Co-operation and Development’s International Network on Financial Education to promote inclusion of financial planning in global financial literacy efforts;

Conducted global research and promoted findings on: firms’ perspectives on CFP certification and hiring CFP professionals (2012); consumer attitudes towards financial planning (2015); and the practice of financial planning and CFP professional’s views on the future of the profession (2016, 2021);

Launched, in 2017, World Financial Planning Day, in partnership with IOSCO’s World Investor Week, to promote the value of financial planning and working with CFP professionals to the global community; and

Submitted over a dozen responses on behalf of the public and global CFP professional community to consultations from IOSCO, OECD and the European Commission and European Supervisory Authorities on matters relating to regulation of financial advice, investor protection and financial literacy.

“It’s been my privilege to have served the international CFP certification program, global financial planning profession and FPSB for two decades,” said FPSB CEO Noel Maye.

“I’m humbled by what the FPSB team, FPSB Network and global CFP professional community have collectively achieved on behalf of the public and the profession. The time is right for me to step back, support the transition to FPSB’s next CEO, and cheer on the FPSB board, team and global financial planning community to new heights,” he said.

FPSB Board Chairperson, Garry Muriwai, extended his thanks to Noel for his drive and passion for the FPSB mission and vision.

“FPSB has achieved a lot and substantially raised the global profile of financial planning and CFP certification under Noel’s leadership. The FPSB Board and I are grateful for his contribution and leadership and appreciate his commitment to supporting an orderly transition to a new CEO later this year,” he said.

The FPSB Board of Directors has begun working with the FPSB leadership team and an external consultant on the CEO transition process. While the Board has pre-identified a strong candidate, FPSB is committed to a fair, transparent approach to evaluating internal and external candidates for the position. Candidates interested in the role can submit a cover letter and resume/curriculum vitae to [email protected] by Friday, 10 June.

About FPSB Ltd.

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Colombia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2021, there were 203,312 CFP professionals worldwide. For more, visit fpsb.org.

Number of CERTIFIED FINANCIAL PLANNER® Professionals in India Increased By 17% Over Previous Year

DENVER – 22 FEBRUARY 2022 – Financial Planning Standards Board Ltd. (FPSB Ltd.), owner of the international CERTIFIED FINANCIAL PLANNER® certification program in India, announced today that the number of CFP® professionals in India grew by 17.6% last year, reaching a total of 2,338 CFP professionals at 31 December 2021. The CFP professional growth story in India is part of a growing global movement, where last year saw the number of CFP professionals around the world reach an all-time high of 203,312. “Despite the COVID-19 pandemic, momentum in the growth of CFP professionals in India is strong and increasing, consistent with global trends for the CFP certification program,” said Noel Maye, CEO of FPSB Ltd. “India’s rate of growth of CFP professionals placed it in the top three globally, after Brazil and Indonesia with growth rates of 36% and 22%, respectively. And India’s net increase of 349 CFP professionals ranks it in the top seven growth territories globally. FPSB Ltd. is deeply grateful to our supporters in India, including our education providers, and to all CFP professionals in India who commit to rigorous standards and to putting their clients’ interests first.” Since taking over direct operation of the CFP certification program in India in 2019, FPSB Ltd. has updated the curriculum for CFP certification, which is available through FPSB Ltd.’s online learning portal or one of 16 education providers; introduced three specialty designations as a career path to CFP certification; partnered with the NSE Academy and an online exam provider to offer certification exams throughout India; and facilitated online and in-person Continuing Professional Development (CPD) opportunities for CFP professionals to retain their certification. These, and other efforts, have resulted in 1,602 candidates enrolling in our education and certification programs and 621 newly-minted CFP professionals last year. “While the CFP certification program in India last year was a success story, with less than 2,400 CFP professionals, the potential for growth in the country is enormous,” added Maye. “India has a massive population of young, educated people looking to establish themselves in rewarding careers and to demonstrate their capabilities against a global standard. FPSB Ltd. will work with our stakeholders in India to prepare new entrants to the profession and to deepen connections among practitioners, employers, associations, regulators and government to promote and support the emergence of financial planning in India as a valued and respected profession, with CFP certification its symbol of excellence.” To learn more about worldwide CFP professional growth in 2021, view the infographic on FPSB Ltd.’s website.

About FPSB

FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP certification and other programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Columbia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2021, there were 203,312 CFP professionals worldwide, with 2,338 of those in India. For more, visit fpsb.org.

Financial Planning Standards Board Launches Final Education Course Leading to CFP Certification in India

Experienced CFP professionals to serve as mentors for course takers as part of FPSB Ltd.’s innovative contribution to financial skills development in India

India, Maharashtra, MUMBAI – 05 July 2021 – Financial Planning Standards Board Ltd. (FPSB Ltd.), the organization that leads the global financial planning profession and owns the CERTIFIED FINANCIAL PLANNER certification program in India, announced today the launch of its FPSB® Integrated Financial Planning Course. This comprehensive financial planning course, which integrates global and local content and includes financial plan assessment and mentorship components, has been designed to enhance and assess the knowledge, skills and abilities of candidates for CERTIFIED FINANCIAL PLANNER® certification in India. Candidates who successfully complete the course, pass the CFP exam and meet additional initial certification requirements will be eligible to join the growing community of more than 2,000 CFP professionals in India and more than 192,000 CFP professionals worldwide. The FPSB® Integrated Financial Planning Course will be delivered through FPSB Ltd.’s online learning platform and consists of the following three interactive modules:

- “Financial Planning Principles, Process & Skills”:Covers the financial planning process and fundamental practices; the benefits and impacts of financial planning; how to apply financial planning principles during client engagements; and the value of professional standards of practice and professional skills.

- “Engaging Clients in the Financial Planning Process”: Focuses on human qualities of the planner-client relationship, and how clients’ values, attitudes and experiences impact the financial planning engagement.

- “Developing Effective Financial Plans”: Provides an overview of the areas to be addressed in developing a financial plan, including how to identify missing information.

To complete the course, candidates for CFP certification are required to develop and be assessed on a financial plan based on a case study issued by FPSB Ltd. Digital textbooks for each module, sample financial plans and supporting materials on creating a financial plan are provided in the course materials and further supplemented in the case study. The FPSB® Integrated Financial Planning Course can be taken through one of FPSB Ltd.’s Authorized Education Providers in India or by self-study. For more information on CFP certification in India and how to register for the FPSB® Integrated Financial Planning Course, go here. As part of the course, FPSB Ltd. is pleased to bring together experienced CFP® practitioners and candidates by introducing an innovative mentorship program. Mentors who have stepped forward to share practical insights, knowledge and experience on the preparation of a financial plan with candidates working towards CFP certification in India are:

- Arun Thukral, CFP, (Mumbai) a startup investor/advisor and BFSI consultant, formerly the managing director and CEO of Axis Securities Limited.

- B. Srinivasan, CFP, (Bengaluru) an entrepreneur, director of Shree Sidvin Group and founder president of the nonprofit Council of Financial Planners (COFP).

- D.V. Suresh, CFP, (Hyderabad) founder of DVS Associates Pvt. Ltd., a financial planning practice advocating sound financial health for all.

- Kavita Devi, CFP, (Nashik) a CTEP Inheritance Planner and Registered Life Planner.

- Naresh Pachisia, CFP, (Kolkata) founder and managing director of SKP Securities Ltd., Eastern India’s leading boutique investment banker.

- Renu Maheshwari, CFP, (Chennai) co-founder of Finscholarz, providing fee-only financial planning and portfolio management services, and the first individual SEBI Registered Investment Adviser (RIA) in Tamil Nadu.

- Col. Sanjeev Govila (Retd), CFP, (Delhi) an individual SEBI RIA, founder and CEO of Hum Fauji Initiatives, a company dedicated to armed forces officers and their families.

“As interest in CFP® certification continues to grow around the world, FPSB Ltd. is committed to supporting candidates on their journey to becoming CFP professionals in India,” says Noel Maye, FPSB Ltd. CEO. “CFP certification is the global symbol of excellence in financial planning, and I’m pleased the education course offerings leading to CFP® certification in India are now complete with the addition of the FPSB® Integrated Financial Planning Course. Mentorship is a beautiful approach to foster synergies between candidates and practitioners, and I’m excited to see this program develop.”

About FPSB Ltd. FPSB manages, develops and operates certification, education and related programs to benefit the global community by establishing, upholding and promoting worldwide professional standards in financial planning. FPSB demonstrates its commitment to excellence with the marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER and CFP Logo Mark – which it owns outside the United States. FPSB and the FPSB global network administer CFP and other certification programs in the following 27 territories: Australia, Austria, Brazil, Canada, Chinese Taipei, Columbia, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Japan, Malaysia, the Netherlands, New Zealand, People’s Republic of China, Peru, Republic of Korea, Singapore, South Africa, Switzerland, Thailand, Turkey, the United Kingdom and the United States. At the end of 2020, there were 192,762 CFP professionals worldwide.

Financial Planning Standards Board Launches Advisory Council to Steer Growth and Value of CFP Certification in India

Financial Planning Standards Board Ltd. (FPSB), owner of the CERTIFIED FINANCIAL PLANNER® certification program in India, has launched the CFP Professional Advisory Council to foster financial planning professionalism in the public interest, provide input and thought leadership on FPSB’s mission and priorities, and grow the number of CFP professionals in India The following seven founding members of the Council, each of whom are leaders in the profession, reflect the geographic, gender and practice diversity within the Indian CFP professional community:

- Arun Thukral, CFP, Council Chair, (Mumbai) a startup investor/advisor and BFSI consultant, formerly the managing director and CEO of Axis Securities Limited, and member of the Confederation of Indian Industry (CII) National Committee on Financial Markets.

- B. Srinivasan, CFP, (Bengaluru) an entrepreneur, director of Shree Sidvin Group and founder president of the nonprofit Council of Financial Planners (COFP).

- D.V. Suresh, CFP, (Hyderabad) founder of DVS Associates Pvt. Ltd., a financial planning practice advocating sound financial health for all.

- Kavita Devi, CFP, (Nashik) a CTEP Inheritance Planner and Registered Life Planner, dedicated to helping people in the journey to financial freedom.

- Naresh Pachisia, CFP, (Kolkata) founder and managing director of SKP Securities Ltd., Eastern India’s leading boutique investment banker.

- Renu Maheshwari, CFP, (Chennai) co-founder of Finscholarz, providing fee-only financial planning and portfolio management services, and the first individual SEBI Registered Investment Adviser (RIA) in Tamil Nadu.

- Col. Sanjeev Govila (Retd), CFP, (Delhi) an individual SEBI RIA, founder and CEO of Hum Fauji Initiatives, a company dedicated solely to armed forces officers and their close family members.

“The founding members of the CFP Professional Advisory Council offer a wealth of knowledge and experience that will support our efforts to build a vibrant and thriving CFP professional community in India,” said Rajesh Krishnamoorthy, Country Head, FPSB India Liaison Office. “I look forward to leveraging the diverse background and insight of this group to expand CFP certification and increase access to competent and ethical financial planning advice in India.”

FPSB Names Rajesh Krishnamoorthy to Lead in India

Financial Planning Standards Board Ltd. (FPSB) has named financial services veteran and fintech pioneer Rajesh Krishnamoorthy as Country Head, India, effective 1 February. In the role, Krishnamoorthy will oversee FPSB operations and strategy; grow FPSB certification programs; and build support to establish and grow the financial planning profession in India, with CFP certification as its symbol of excellence. Krishnamoorthy brings to FPSB 20 years of experience in Indian financial markets, including the last decade with wealth management fintech platform iFAST Financial India Pvt. Ltd., as the founding employee, Managing Director, and most recently Vice Chairman of the Board of iFast India Holdings, Singapore. His experience spans treasury management, securitization, institutional sales, private wealth management, and personal finance-related technology platforms. Please see the full announcement for more details.

The July 2021 Edition of the Journal of Financial Planning in India Is Now Available

FPSB Ltd. is pleased to present the July 2021 edition of the Journal of Financial Planning in India. In this edition, we’ve compiled articles featuring insights and opinions from our community of CFP® professionals and industry experts in India, as well as from territories within our FPSB global network. We understand that Continuing Professional Development (CPD) is important to you, so inside you’ll find an opportunity to earn five (5) CPD points for passing the quiz. We hope this journal and future editions will become a staple in furthering your professional development and connecting you to the global financial planning profession. We look forward to enriching articles from our CFP Certificant community for the future editions of the Journal. Read the Journal of Financial Planning in India Or click here to download a print-ready PDF

FPSB Ltd. – Global Press Releases

- Number of CFP professionals worldwide increases 5.1% to meet the growing demand for financial planning advice

- FPSB India Names Krishan Mishra As New CEO

- CERTIFIED FINANCIAL PLANNER Professionals Worldwide Surpasses 213,000

- Financial Planning Standards Board Names 2023 Leadership from Australia, Brazil, Canada, Ireland, Japan, the Netherlands and Singapore

- Financial Planning Standards Board Ltd. Names Dante De Gori, CFP®, As New CEO

- FPSB, Global CFP Professional Community Promote Value of Financial Planning During 6th World Financial Planning Day

- Financial Planning Standards Board Recommends Enhanced Oversight of Crypto Assets and Fin-fluencers To Protect Investors

- Noel Maye To Step Down As Financial Planning Standards Board Ltd. CEO

- Number of CERTIFIED FINANCIAL PLANNER Professionals Worldwide Tops 203,000

- Financial Planning Standards Board Launches Final Education Course Leading to CFP Certification in India

FPSB Ltd. – India Press Releases

- Number of CERTIFIED FINANCIAL PLANNER® Professionals in India Increased By 7% Over the Previous Year

- Financial Planning Standards Board Names Rajesh Krishnamoorthy to Lead FPSB Operations and Grow CFP Certification in India

- Financial Planning Standards Board Launches New Pathway to CERTIFIED FINANCIAL PLANNERCM Certification in India

- FPSB Ltd.’s CFP Certification Accredited by India’s National Institute of Securities Markets

FPSB Ltd. – Global Press Releases

- Financial Planning Standards Board Announces 2020 Priorities

- Financial Planning Standards Board Reports Record Number of CERTIFIED FINANCIAL PLANNER Professionals Worldwide

- Financial Planning Standards Board Celebrates 15 Years; Envisions Bright Future for Global Financial Planning Profession

- Financial Planning Standards Board Issues First Guidance Practice Note to Support Financial Planners Working with Vulnerable Clients